The amount of bottom slag processed in 2019 was slightly smaller than in the previous year. The work we have done together with our partners Lakeuden Etappi Oy and Suomen Erityisjäte Oy in developing the processing of slag further has taken steps forward. The treatment of bottom slag and the processing methods are undergoing constant development and the achieved efficiency has brought added cost savings.

The maintenance costs were slightly above the estimate, primarily for the comprehensive maintenance during the shutdown. This year, Westenergy operated a three-week annual maintenance and investment shutdown, during which extensive maintenance, repair and replacement works as well as new investments were carried out.

The chemical costs remained well within the estimate. In total, the variable costs were significantly lower than in the previous year and well within the estimate.

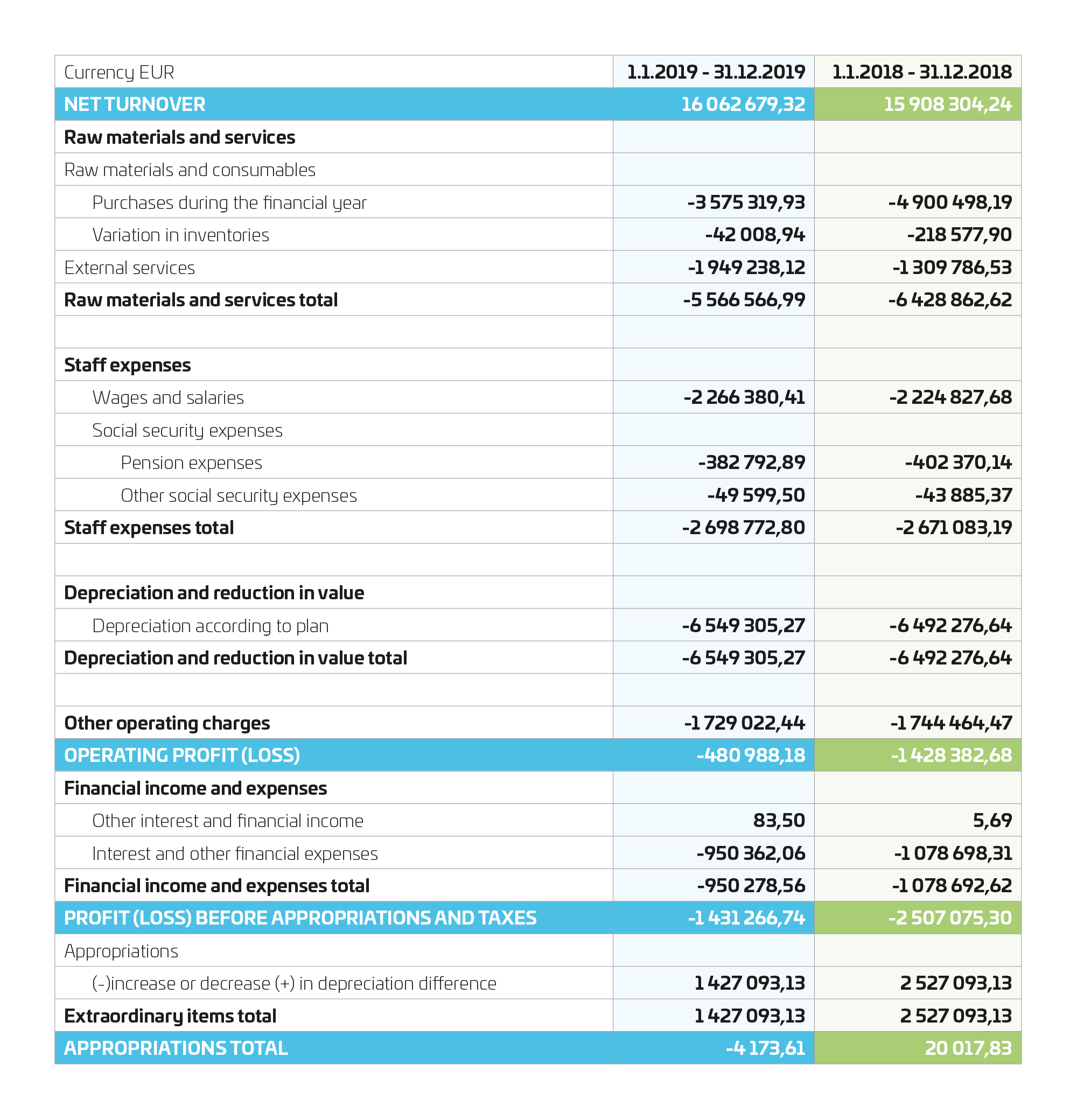

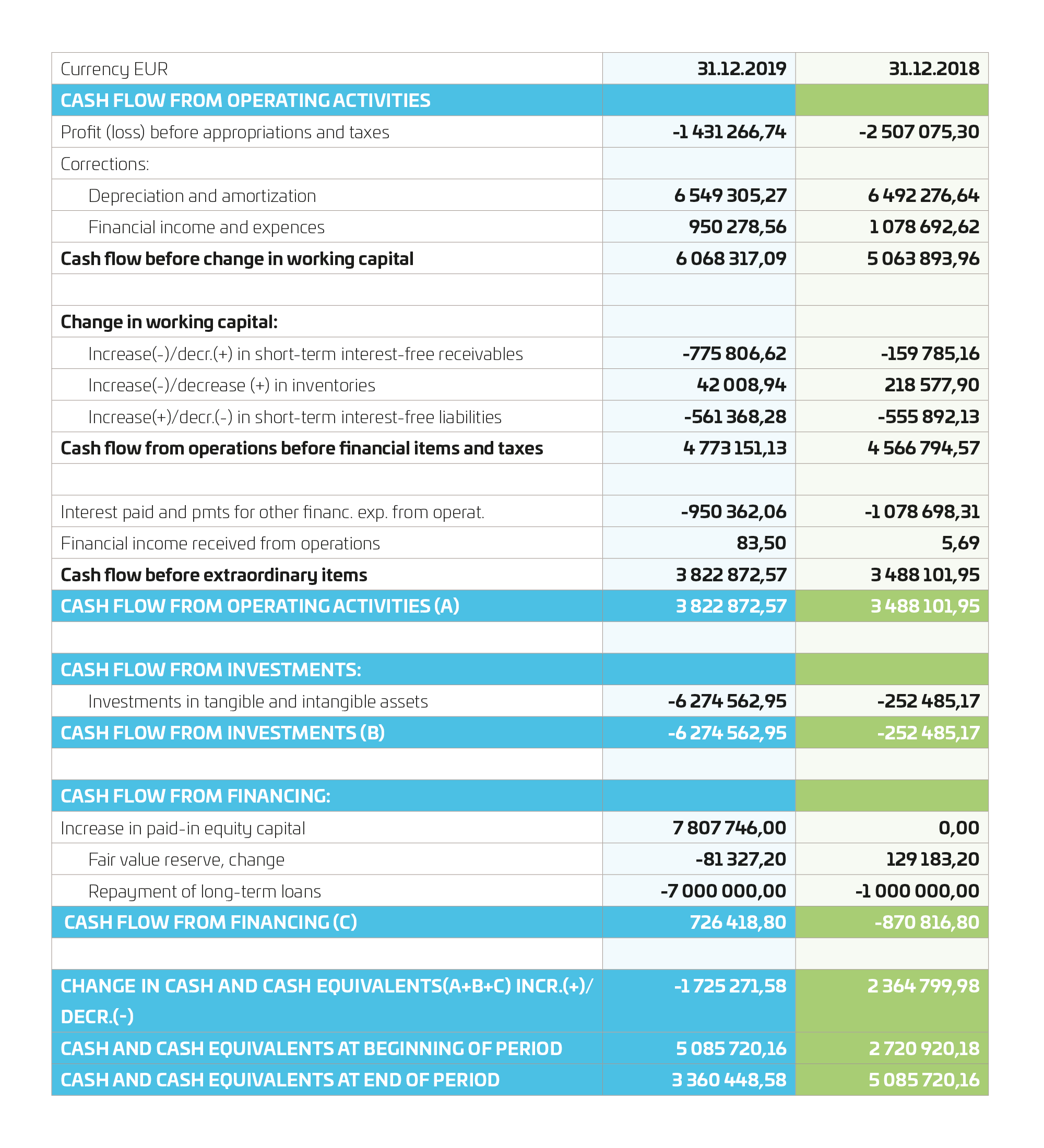

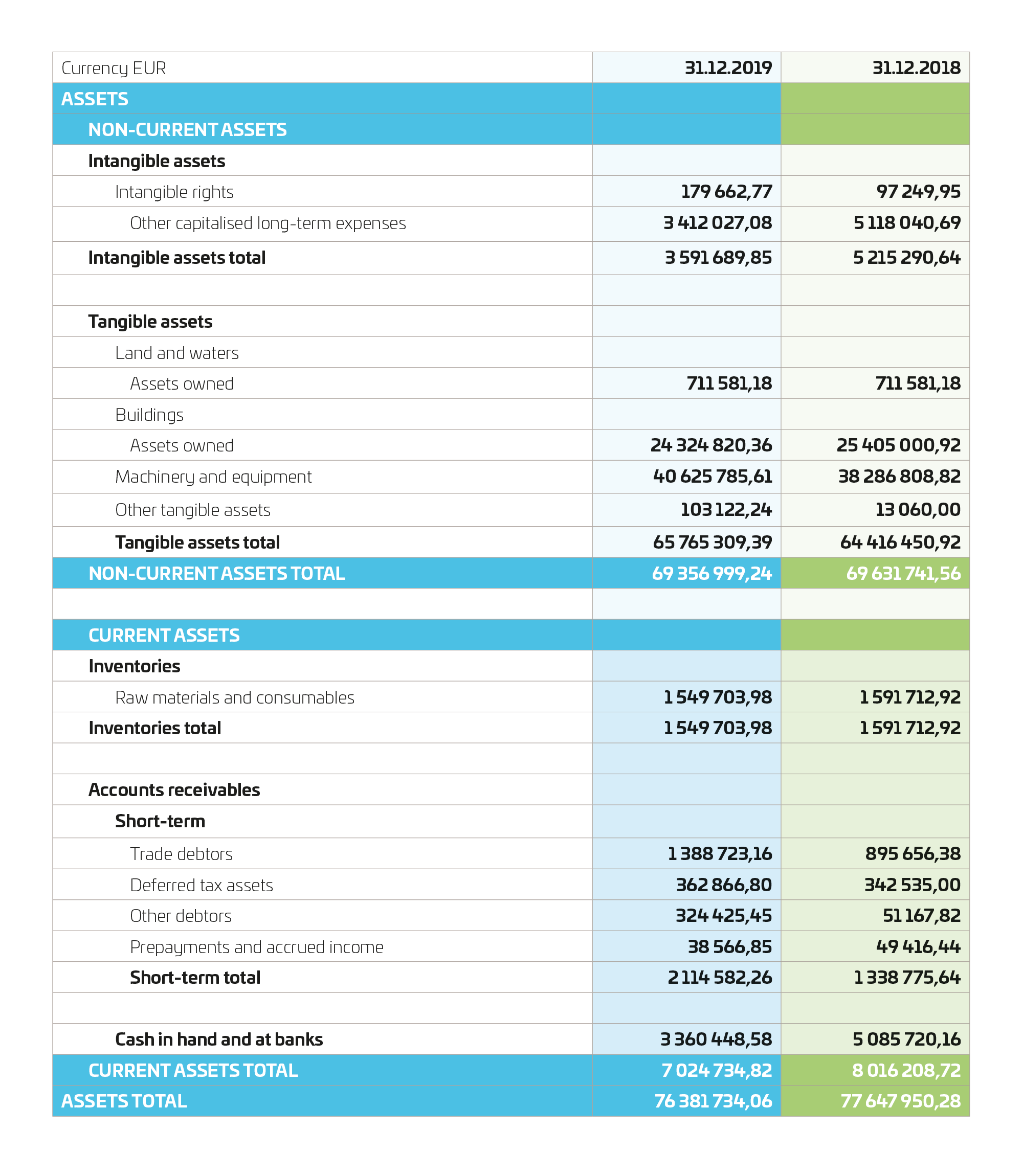

The total amount of investments made in 2019 came to EUR 6,274,563. The biggest investment in the year was the flue gas scrubber. The investment was made in response to stricter environmental standards to be applied in the treatment of flue gasses, and the investment also supports the improved energy efficiency of our plant. Thanks to the major investment, we will be able to comply with the provisions of the EU’s 2019 BREF document. We will also be able to recover heat energy from the flue gases, increasing Westenergy’s district heat output by a further 20%. This further increases the role of Westenergy in the district heat production for Vaasa region. Other main investments during the year under review included the upgrade of the primary air system capacity, the penstock valves of the slag extinguisher, replacement of baghouse filter transporter and auxiliary devices, replacement of pressure reduction and relief valves and glucol heat exchanger.

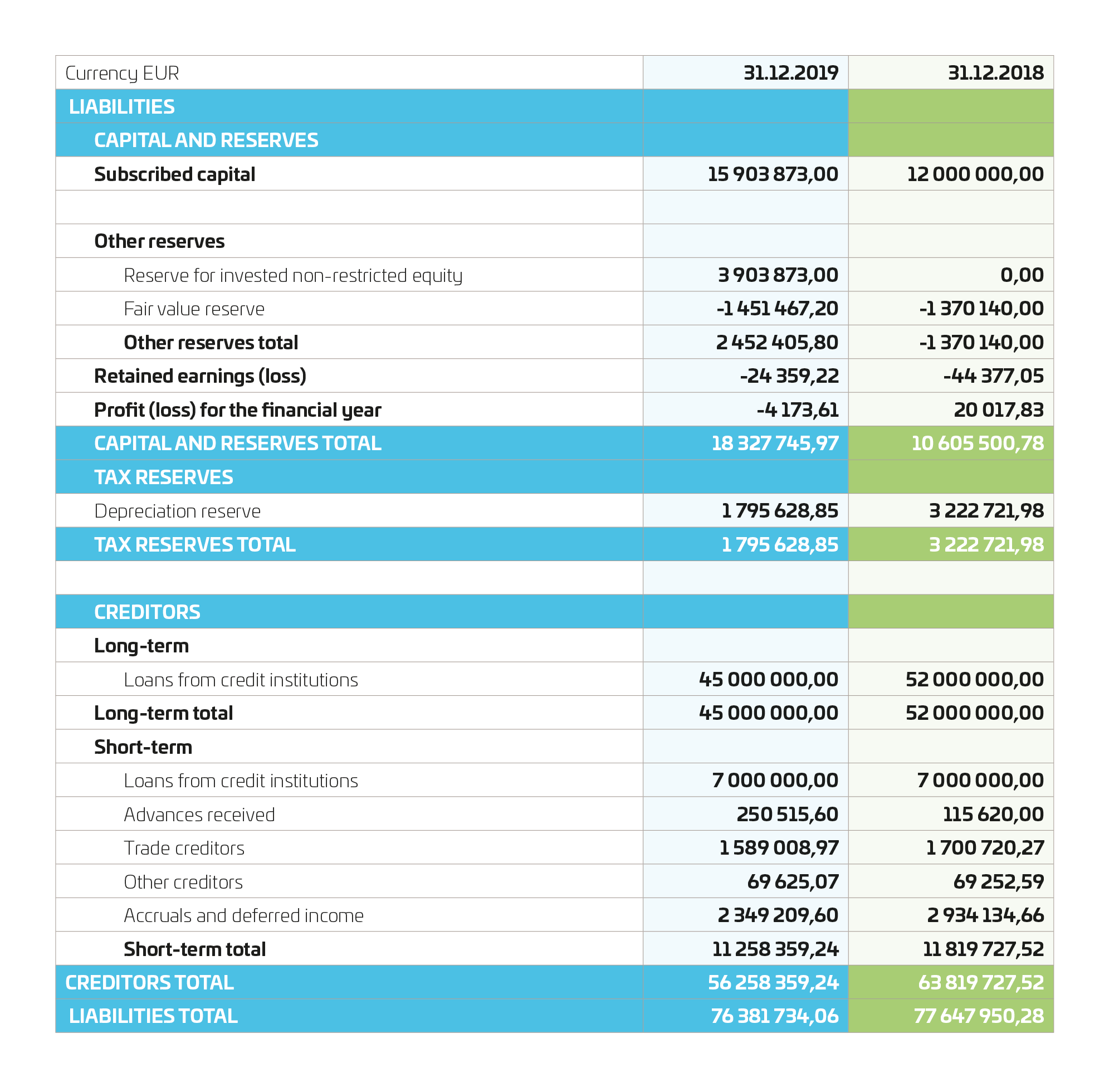

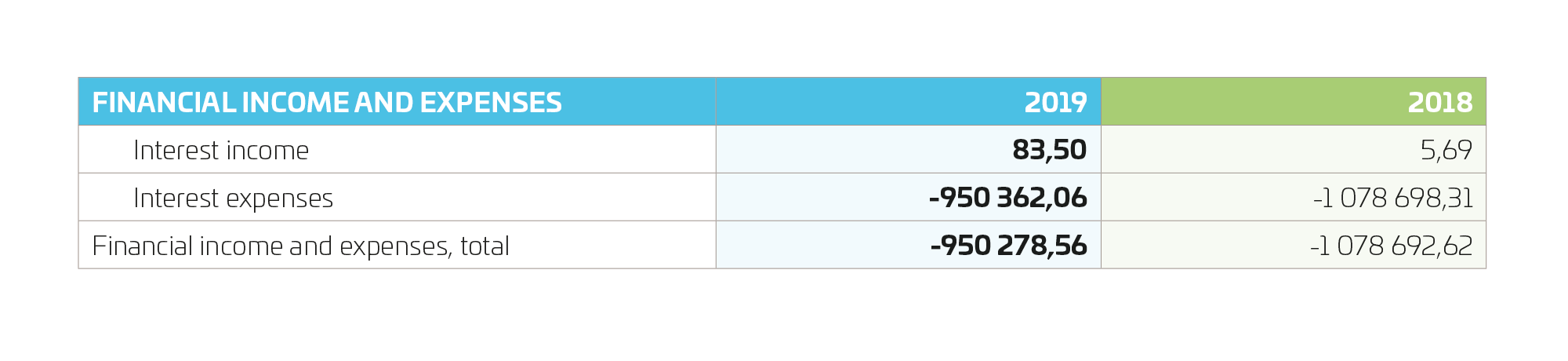

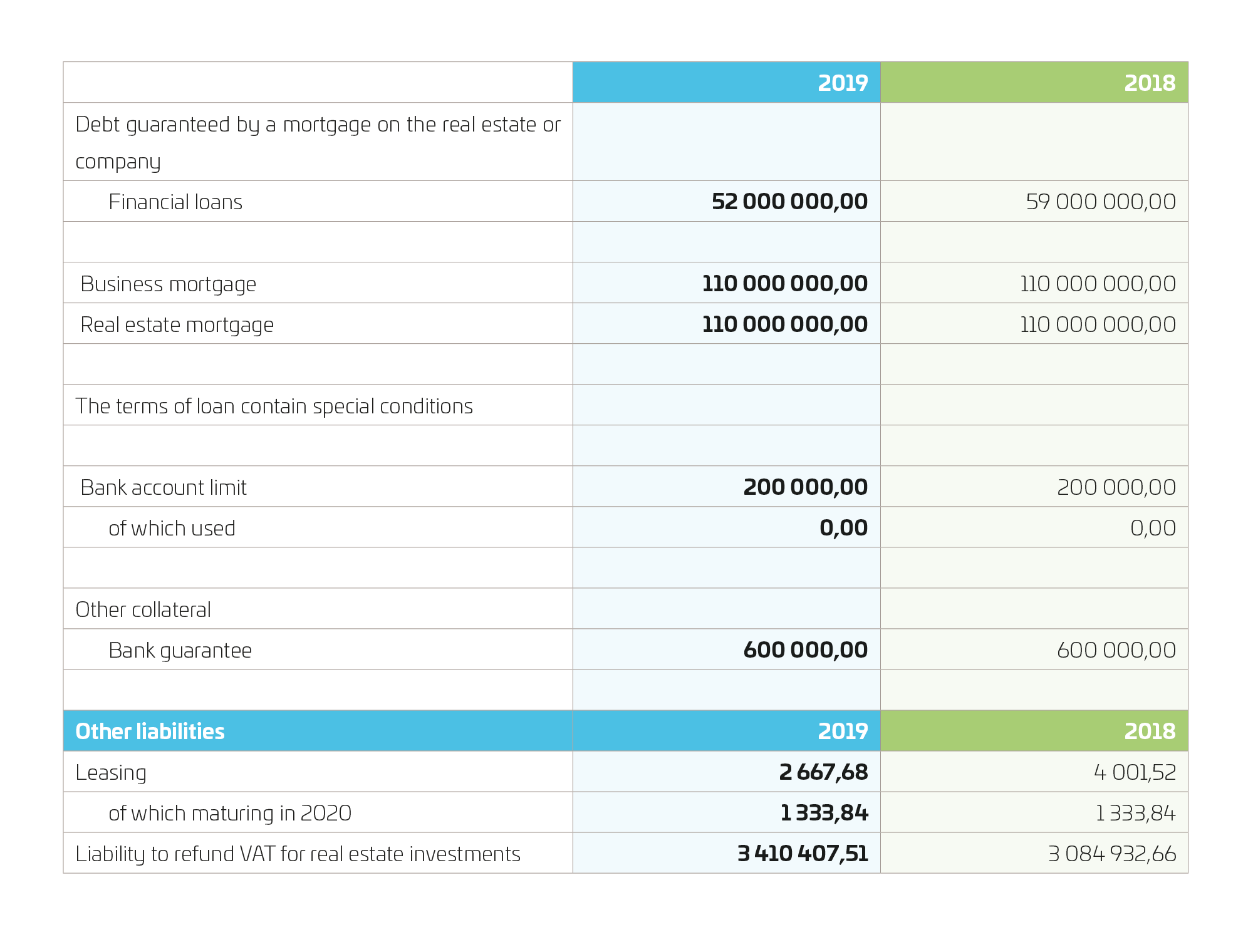

The company’s cash position continues to be good. The company obtained new capital through directed share issues. Alongside the existing owners Oy Botniarosk Ab, Lakeuden Etappi Oy, Millespakka Oy, Ab Stormossen Oy and Vestia Oy, a new owner Loimi-Hämeen jätehuolto Oy acquired a significant holding in the company. A portion of the new capital was posted under reserve for invested unrestricted equity. The company has hedged nearly 100 per cent of its non-current liabilities with financial instruments against adverse developments in the financial markets in order to reduce the fluctuations in its financial results as well as its financial risks.

Westenergy has sharpened its strategy during the year under review. The strategy is aligned with the climate and circular economy targets of the EU and Finland. Westenergy collaborated with its owner companies and other stakeholders in innovating and seeking new solutions for the future. Westenergy has acted as a pioneering force in defining the Green Deal package for the industry. Westenergy provides strong support to development projects and scientific research into circular economy and climate questions, working in close relationship with the University of Vaasa and VEBIC. Based on our strategy work, we have launched several development projects related to CO2 capture, more efficient utilisation of biofuels, conversion of non-recyclable waste fractions into energy and other materials, investigating potential additional capacity as well as the circular economy road map and building a waste-to-energy ecosystem. The company has also participated actively in the development of local circular economy together with the municipality of Mustasaari, Vaasanseudun Kehitys Oy and Ab Stormossen Oy.

Westenergy Oy Ab is committed to following the quality, environmental and occupational health and safety policies which the company has defined. Through certified systems, Westenergy Oy Ab aims to improve the overall quality and cost-effectiveness of its operations. An occupational health and safety system is used to manage known risks, maintain the health and working ability of employees and improve the occupational health and safety. Westenergy Oy Ab aims at managing environmental risks with actions and programmes defined in the environmental system. Westenergy Oy Ab reports new developments concerning the quality, environment and occupational health and safety to interest groups primarily in the form of an annual report. Westenergy’s management system, which complies with the standards of quality (ISO 9001:2015), environment (ISO 14001:2015) and new occupational health and safety (ISO 45001:2018), has been evaluated by an independent external evaluator in 2019.

The company employed 30 people at the beginning of the financial period and 32 people at the end of the financial period. The average number of employees during the year was 35. The salaries and remuneration paid in 2019 totalled EUR 2,266,380. The following table includes some key figures related to the personnel.